The 2021 property tax mill rates have been set for Calgary and Edmonton. Both cities were able to maintain competitive tax rates, with only moderate changes from 2020 rates.

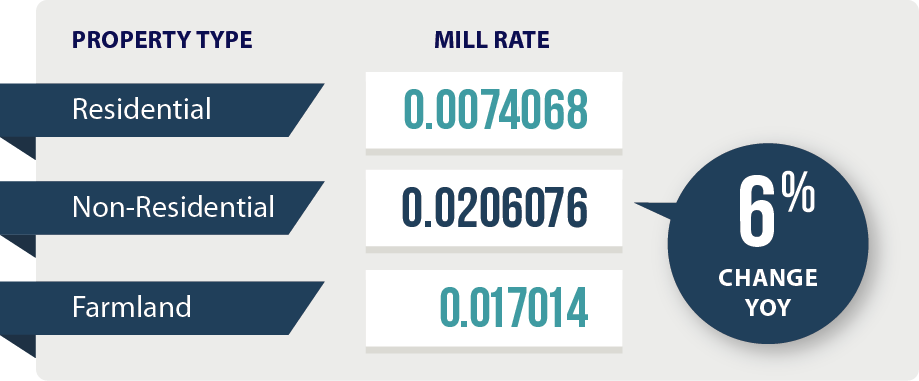

In Calgary, the non-residential tax rate has increased 6% year over year because of a tax shift from non-residential to residential properties.

In Edmonton, there has also been a slight increase to the non-residential tax rate. While the non-residential tax rate has increased by 9%, it continues to remain relatively stable because of the freezing of provincial education taxes.

Residents and owners of properties in these two municipalities should expect property tax notices to be mailed on May 25, 2021 for Calgary and in late May for Edmonton.

Property owners are reminded that, to avoid any penalties, taxes must be paid by the deadline stated on the notice, regardless of any active appeal in respect of the property.

Assessment Requests for Information

Assessment Requests for Information (ARFIs) have been sent out by Calgary and Edmonton.

Issued by municipalities to confirm specific property details, responding to an ARFI is important in maintaining the accuracy of the assessment roll. Given the impact of COVID-19, it is especially important to report any changes in tenant information, as this may affect the upcoming year’s property tax assessment.

In addition, completing the ARFI maintains a property owner’s right to appeal an assessment – if a response is not submitted, the taxpayer’s right to appeal may be forfeited for the following year.

More Information

With more than 850 global professionals in 41 cities, Ryan has the local market expertise and resources to successfully manage your organization’s property tax obligations. Our integrated team, including designated appraisers, former local assessment officials, engineers, attorneys, paralegals, and financial analysts, can maximize potential property tax refunds, while ensuring compliance with the regulatory requirements in all Canadian jurisdictions.

For more information or to discuss a recent assessment or ARFI, please contact your Ryan account representative or the Ryan TaxDirect® line at 1.800.667.1600.

- Sujet

- Taxes foncières

- Alberta