Tax Alert | 2024 Newfoundland and Labrador Property Tax Appeal Deadlines

Tax Development Jul 13, 2023

Tax Development Jul 13, 2023

The 2024 appeal deadlines for Newfoundland and Labrador property assessments are rapidly approaching. Property owners of industrial and commercial complexes who wish to review their assessment have the right to file an appeal with the assessment review court.

Key Considerations

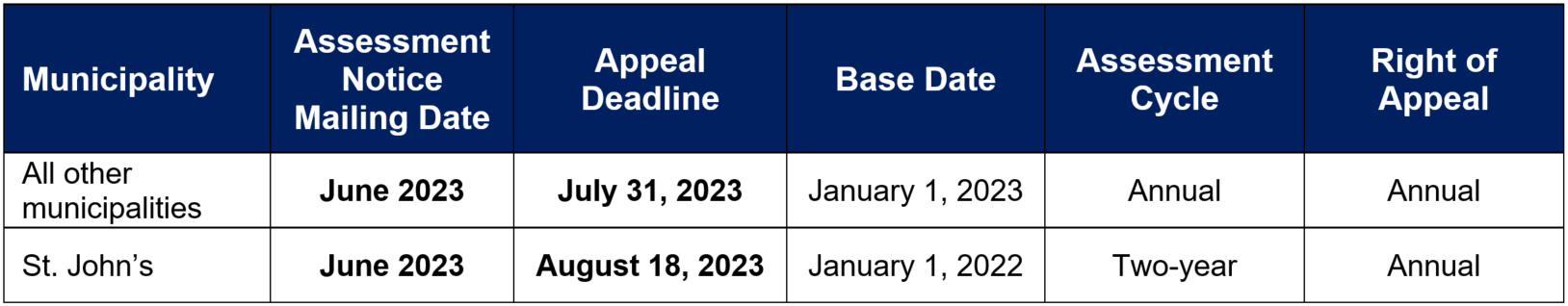

The City of St. John’s is subject to a two-year property tax assessment cycle with an annual right of appeal, while properties in the rest of the province are subject to assessment annually. All property values in the province are assessed as of a reference date (also known as the base date), with land and all improvements taken into consideration. The base date for St. John’s is January 1, 2022, but for all remaining municipalities, it is January 1, 2023.

Appeal Deadlines

After the appeal deadline, the municipal assessment will become fixed for the current year.

How Ryan Can Help

An increase or decrease in your property’s assessed value may affect the amount of property taxes you pay. Our team of experts has more than 40 years of experience in reviewing assessments and managing administrative reviews for all types of properties. We can help ensure that your property tax assessment is fair and consistent and, if necessary, provide assistance in filing a request for administrative review.

If you have any questions or uncertainty about your recent property tax assessment in Newfoundland and Labrador, please contact your Ryan representative by July 21, 2023.