Alberta Assessment Year Modifier Increases Could Once Again Result in Property Tax Increases for Regulated Properties

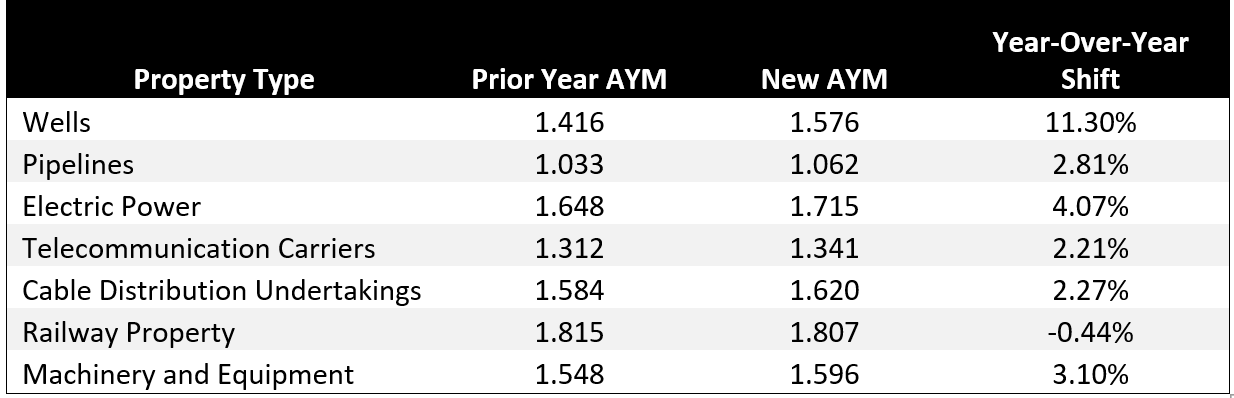

Alberta Municipal Affairs has released its guidelines for regulated properties, including wells, pipelines, electric power facilities, telecommunication carriers, cable distribution undertakings, railway properties, and machinery and equipment, for the 2024 taxation year. The assessment year modifiers (AYMs) have been updated in the guidelines and are detailed below.

The changes to the AYMs for the 2024 taxation year once again include a marked increase for wells.

While increases in AYMs do not always translate to corresponding property tax increases, as municipalities are able to adjust tax rates to offset increases in assessed value, we are anticipating tax increases for some of the above noted regulated properties in 2024.

On a positive note, while there had been much talk about the removal of the Shallow Gas Tax Relief Initiative (SGTRI) 35% reduction for pipelines and wells, we are pleased to report that this reduction remains in place for the 2024 taxation year. Furthermore, the additional depreciation for low producing wells also remains in place for 2024.

Alberta is now in the third year of a provincial government relief program for newly drilled wells and newly constructed pipelines. Companies with new pipeline and well properties saw significant tax savings in 2022 and 2023 and will continue to see savings for one more year.

Alberta’s relief program may be summarized as follows:

For wells drilled between:

- November 1, 2020 and October 31, 2021, three years of tax relief starting in 2022;

- November 1, 2021 and October 31, 2022, two years of tax relief starting in 2023; and

- November 1, 2022 and October 31, 2023, one year of tax relief starting in 2024.

Note that any well drilled prior to October 31 of the relevant year qualifies for government tax relief through 2024. The well license will show on a taxpayer’s assessment, but the property tax owing will be zero and remain that way until the end of the 2024 taxation year.

For pipelines licensed, constructed, and pressure tested before:

- October 31, 2021, three years of tax relief starting in 2022;

- October 31, 2022, two years of tax relief starting in 2023; and

- October 31, 2023, one year of tax relief starting in 2024.

Note that any pipeline that has been constructed, licensed, and pressure tested before October 31 of the relevant year qualifies for government tax relief through 2024. If the pipeline was licensed but not pressure tested before October 31 and is reported on the annual request for information (RFI), it will remain non-assessable until pressure testing is complete, at which time the tax relief will apply as outlined above.

If you have any questions or concerns regarding these changes and how they may impact your 2024 property taxes, please contact our regulated property tax experts using the form below:

- Topics

- Property Tax

- Alberta