Taxpayers are reminded that revaluations for 2023 property tax assessments in Alberta are underway, with the largest municipalities having opened their tax rolls in January. The Notices of Assessment (NOAs) were recently mailed to Calgary and Edmonton non-residential property owners, kicking off the 60-day customer review period. This review period provides owners with an opportunity to review their NOA and determine if an appeal is warranted.

Calgary

NOAs were mailed to all property owners in the first week of January, and the appeal deadline is March 13, 2023.

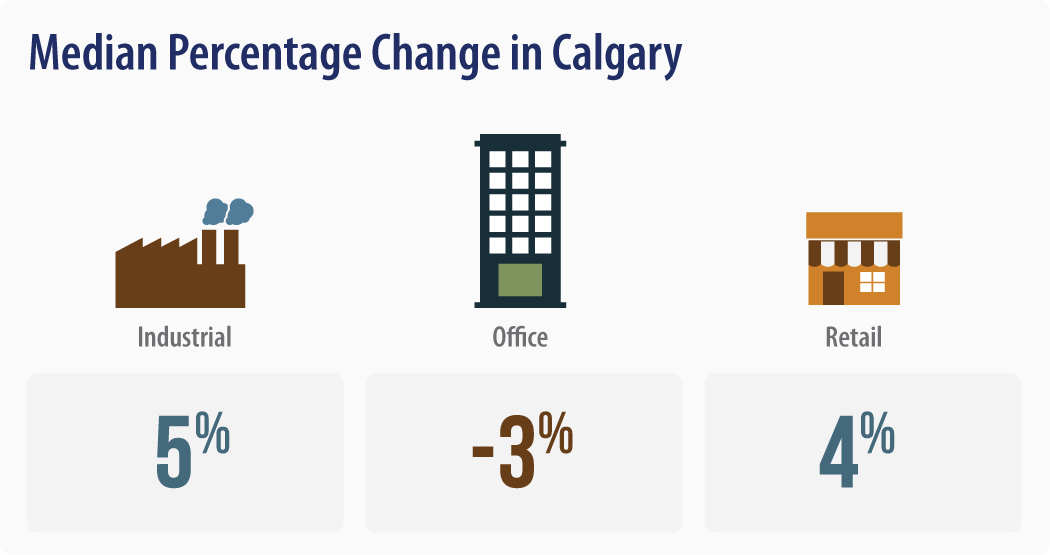

Calgary has a relatively stable non-residential assessment roll tax base. However, the property tax burden will be shifting from office space to industrial and retail properties.

Source: Calgary Property Assessment

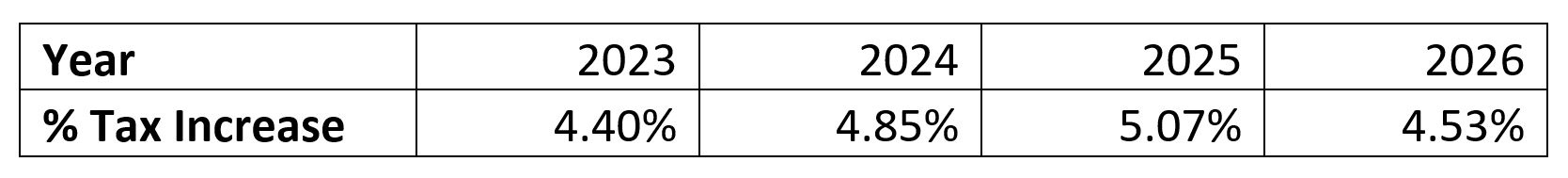

Overall, property taxes in Calgary have been proposed to increase over the next four years.

Edmonton

NOAs were mailed to all property owners in mid-January. The appeal deadline is March 24, 2023.

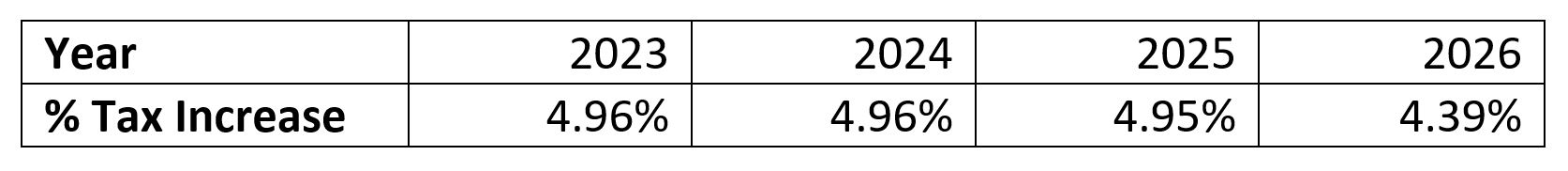

Significant property tax increases are projected for Edmonton business owners over the next four years, with budgeted annual tax increases of nearly 5%.

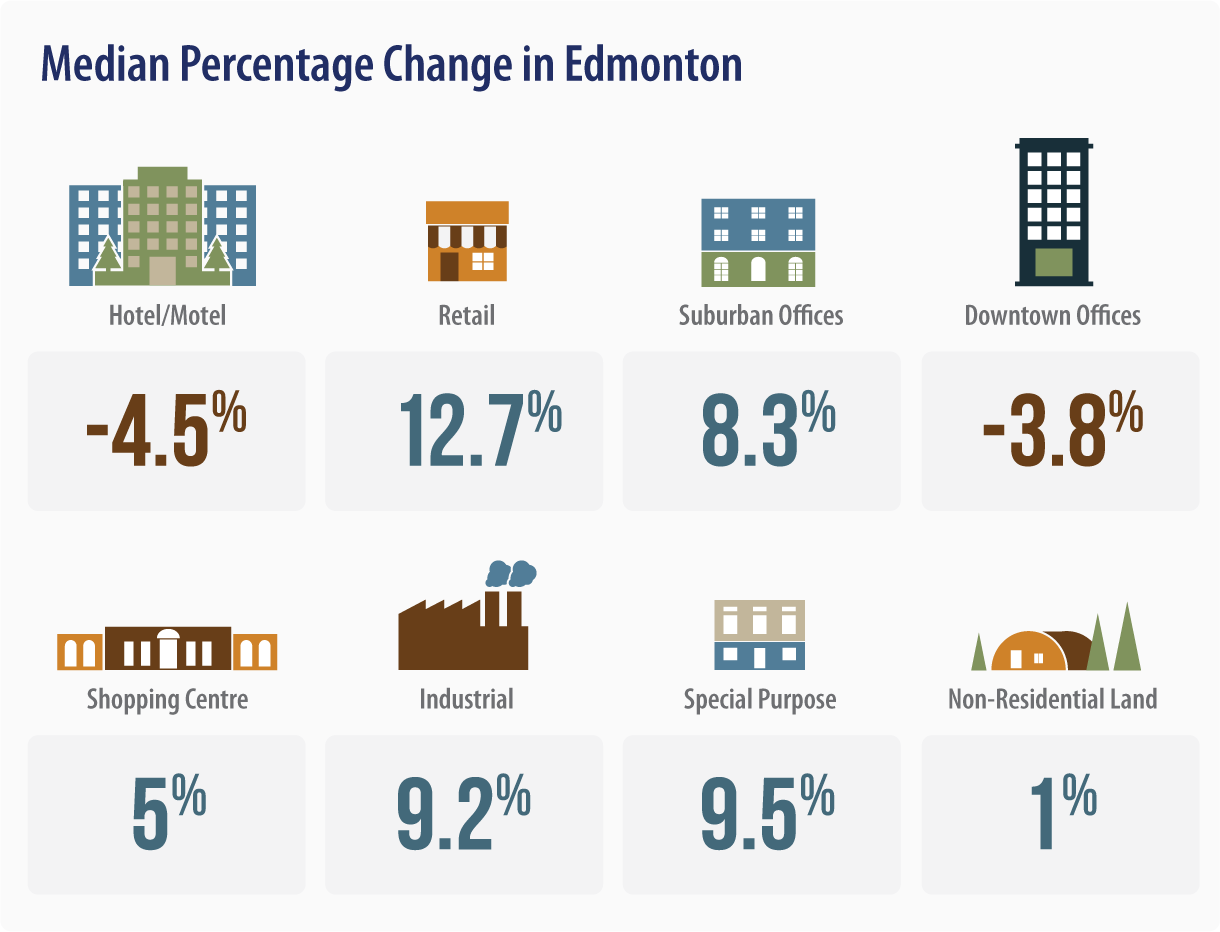

The assessment roll for the 2023 tax year also includes significant shifts in property values for certain asset classes.

Source: Edmonton Property Assessment

On average, retail and industrial properties in Edmonton will pay an even greater share of the increasing property tax burden.

Other Jurisdictions

In Alberta, individual municipalities are responsible for issuing annual NOAs, and mailing dates can vary from year to year. If your portfolio contains properties outside of Calgary and Edmonton, please keep an eye out for these notices.

If you have any questions regarding a specific municipality, please reach out to your Ryan representative for assistance.

Key Considerations

When reviewing your property tax assessment and considering whether it should be challenged, ask yourself the following questions:

- Has the assessment been reviewed or appealed in recent years?

- Is the assessment equitable with that of similar properties?

- Have all economic changes in the market been properly reflected in the valuation?

- Are non-assessable items, such as machinery and equipment, included in the assessment calculation?

- Is the tax classification correct?

- How does the assessment compare to recent sales or listing activity in the area?

- Has there been any demolition or contamination during the tax years covered by the assessment?

More Information

For more information or to discuss your current situation, please contact your Ryan representative or email the Alberta team at ryanabpt@ryan.com.

- Topics

- Property Tax

- Alberta