Boston’s Property Tax Levy and Impacts of Mayor Wu’s Proposed Tax Classification Legislation

By Daniel J. Swift, Esq.

Boston Mayor Michelle Wu recently filed a home rule petition seeking to exceed the allowable threshold of property tax burden borne by the commercial property class while simultaneously reducing the minimum residential tax burden.1 The proposed legislation has created much discussion, as well as much confusion, as to the impacts of the proposal and the current system of property taxation in Boston. This paper aims to clarify Boston’s property tax structure, the current health of its property tax revenue, the tax burdens currently borne by the commercial and residential classes, and, if enacted, the consequences to the commercial and residential classes of property.

I. BOSTON PROPERTY TAX LEVY – AS CURRENTLY CONSTITUTED

To understand the impacts of the proposed legislation, it is important to first understand how Boston levies property taxes and the burdens currently borne by each class.

A. The Property Tax Levy and Proposition 2 ½

The property tax levy represents the total property tax, both real and personal, taken in by the City on an annual basis. The ability to annually increase the tax levy is regulated under Proposition 2 ½, which was enacted in 1980 and codified under Massachusetts General Laws Chapter 59, Section 21C. Proposition 2 ½ operates by detaching the property tax levy, and the ability to annually grow the tax levy, from changes in assessed valuation. As a result, communities within the Commonwealth can rely on continued growth in property tax revenue regardless of fluctuations in assessed valuation.

Under Proposition 2 ½, municipalities are allowed to grow the prior year’s property tax levy by an inflationary factor of 2.5% plus additional property tax associated with new growth, with exceptions for voter approved tax overrides.2 New growth allows communities like Boston to well exceed the annual 2.5% inflationary factor to account for increases in assessed valuation due to construction and development, previously exempt property returning to taxable status, and newly formed subdivisions and condominium conversions.3 The purpose of the new growth addition to the tax levy is to recognize the additional strain new development places on municipal services such as school enrollment and public safety costs.4 The new growth addition is calculated by multiplying the incremental increase in assessed value associated with new growth by the prior year’s tax rate.5 That new growth addition is then added to 102.5% of the prior year’s tax levy to form the new tax levy for the fiscal year. Thereafter, that new growth becomes a permanent part of the tax levy, increasing 2.5% annually.6

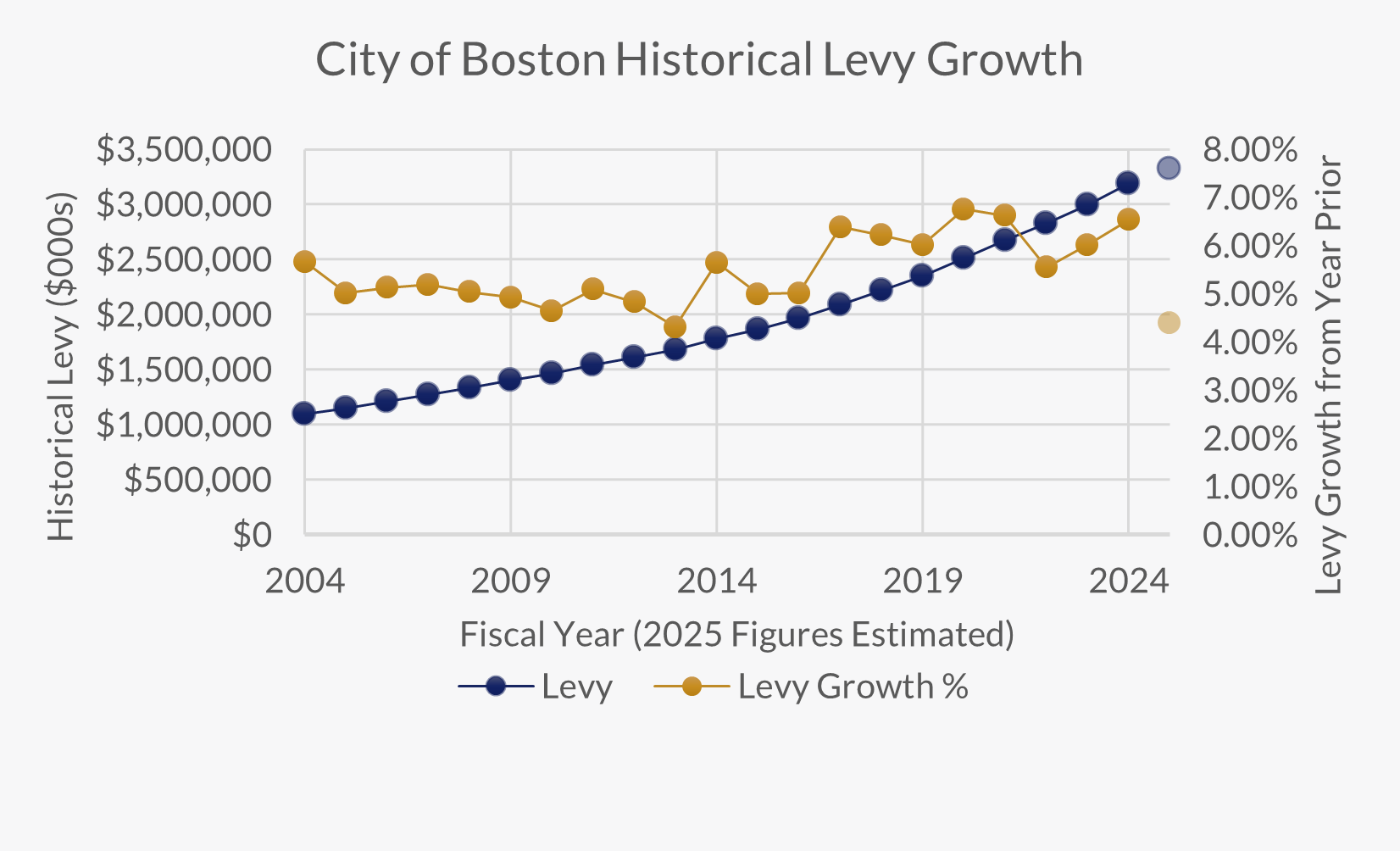

From fiscal year 2004 through fiscal 2024, Boston’s tax levy increased at an average annual rate of 5.5%, with new growth representing the additional levy increase above the 2.5% annual limitation.7 The tax levy has increased from just under $1.1 billion in 2004 to just under $3.2 billion in 2024.8 The Mayor’s recently submitted fiscal 2025 budget reflects an increase in the 2025 tax levy of 4.5%, equating to approximately $3.328 billion in property tax.9 Note that during this 2004 through 2024 timeframe, commercial real estate faced significant value fluctuations, including the impacts of the Great Recession and COVID-19; however, tax revenue to the City of Boston continued to steadily grow as intended under Proposition 2 ½.

The only assessment-related implication under Proposition 2 ½ is that the total property tax levy cannot exceed 2.5% of the total assessed valuation within a municipality.10 There is no concern in this regard for the City of Boston as the tax levy currently represents just 1.4% of total assessed valuation and the residential class, which is appreciating in value, makes up 67% of total assessed valuation.11 It is relevant to note that the assessed values for class “A” and “B” office buildings could drop 100%, and the ratio of tax levy to total assessed valuation would only increase to approximately 1.7%, far below the 2.5% levy cap.12 This will allow Boston to continue to annually grow its property tax levy into the foreseeable future without additional limitation. Therefore, Mayor Wu’s home rule petition is not about concerns over property tax revenue for the City of Boston; rather, it concerns the allocation of tax levy between the two classes of property which are experiencing diverging valuations (residential, which are rising, and commercial, which are falling).

B. Shifting of Tax Burden from Residential to Commercial

1. Assessment Allocations

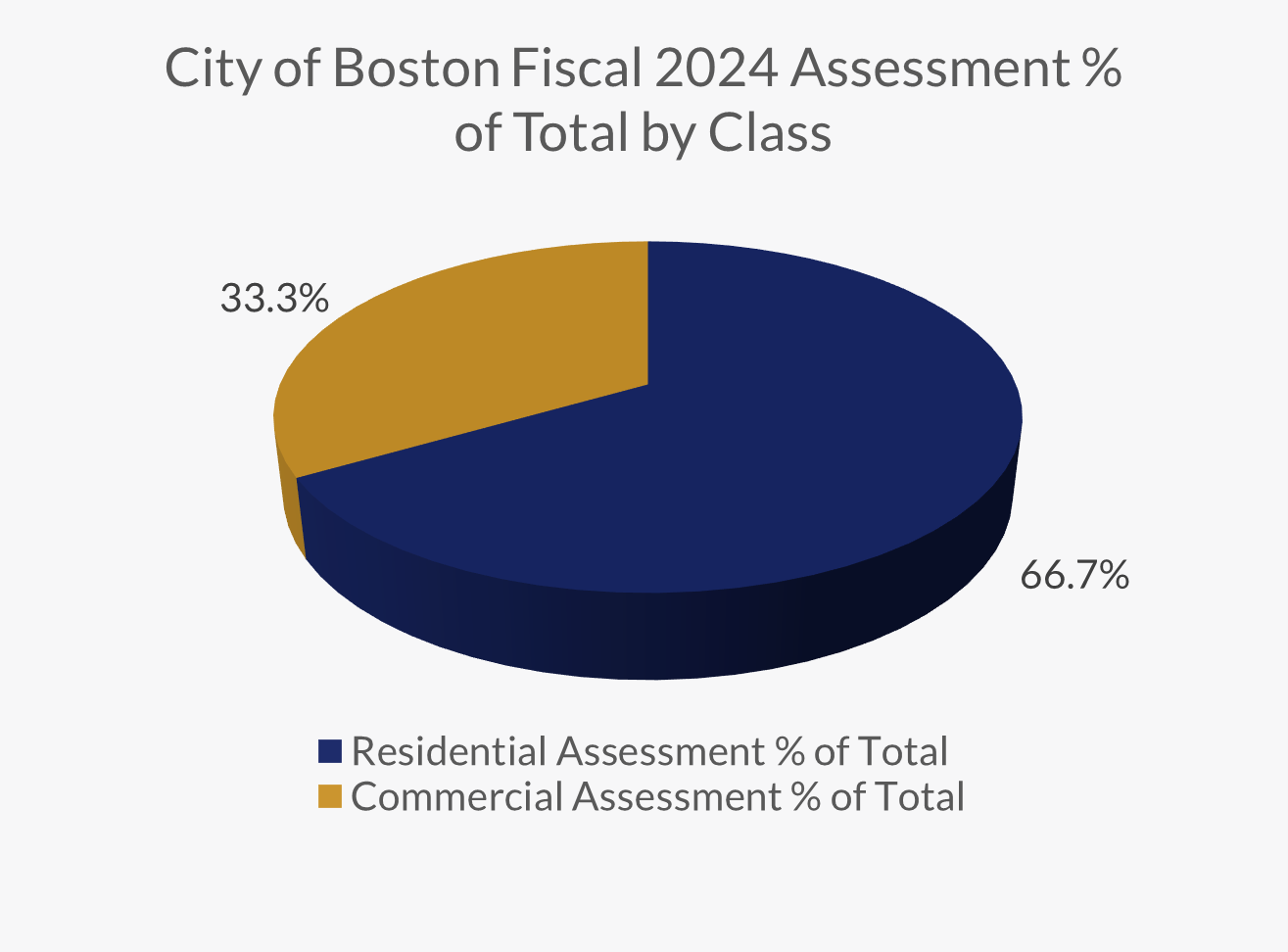

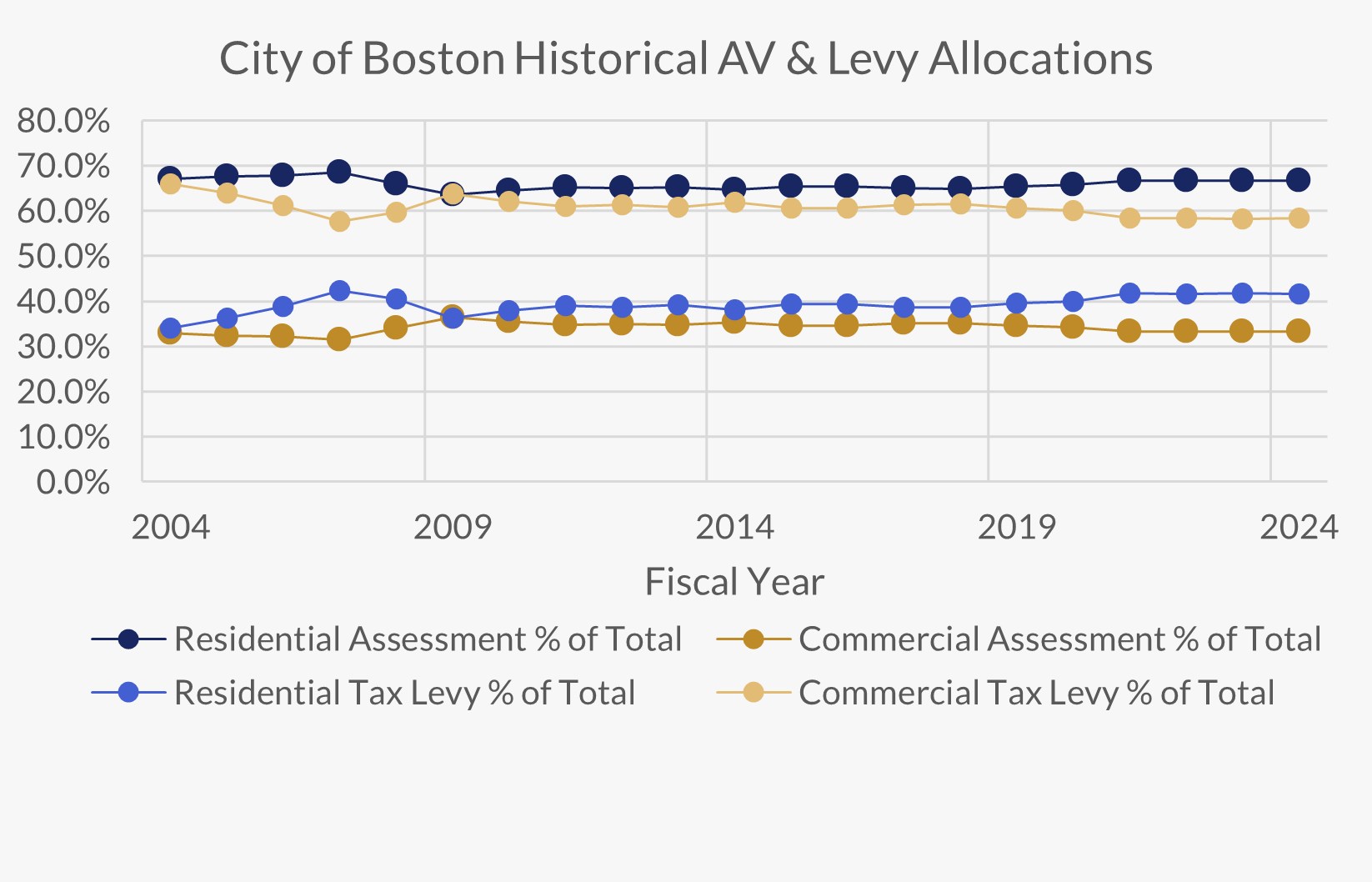

The residential class equated to 67% of the total assessed valuation in the City of Boston for fiscal 2024, with the commercial class comprising the remaining 33% of total value.13 The residential class includes single family, multifamily, apartments, condominiums, affordable housing, supporting residential land and parking, and certain childcare facilities.14 The commercial class includes all other uses such as office, retail, hotel/motel, industrial, life science, commercial parking, health clubs, and personal property.15 Assessments are updated on an annual revaluation based on market value as of the January 1 preceding the fiscal year. Dating back to 2004, the allocation of residential property in the City has ranged from 64 to 73% of total assessed value, meaning commercial property has made up between 27 to 36% of total value.16

2. Burden Shift onto the Commercial Class

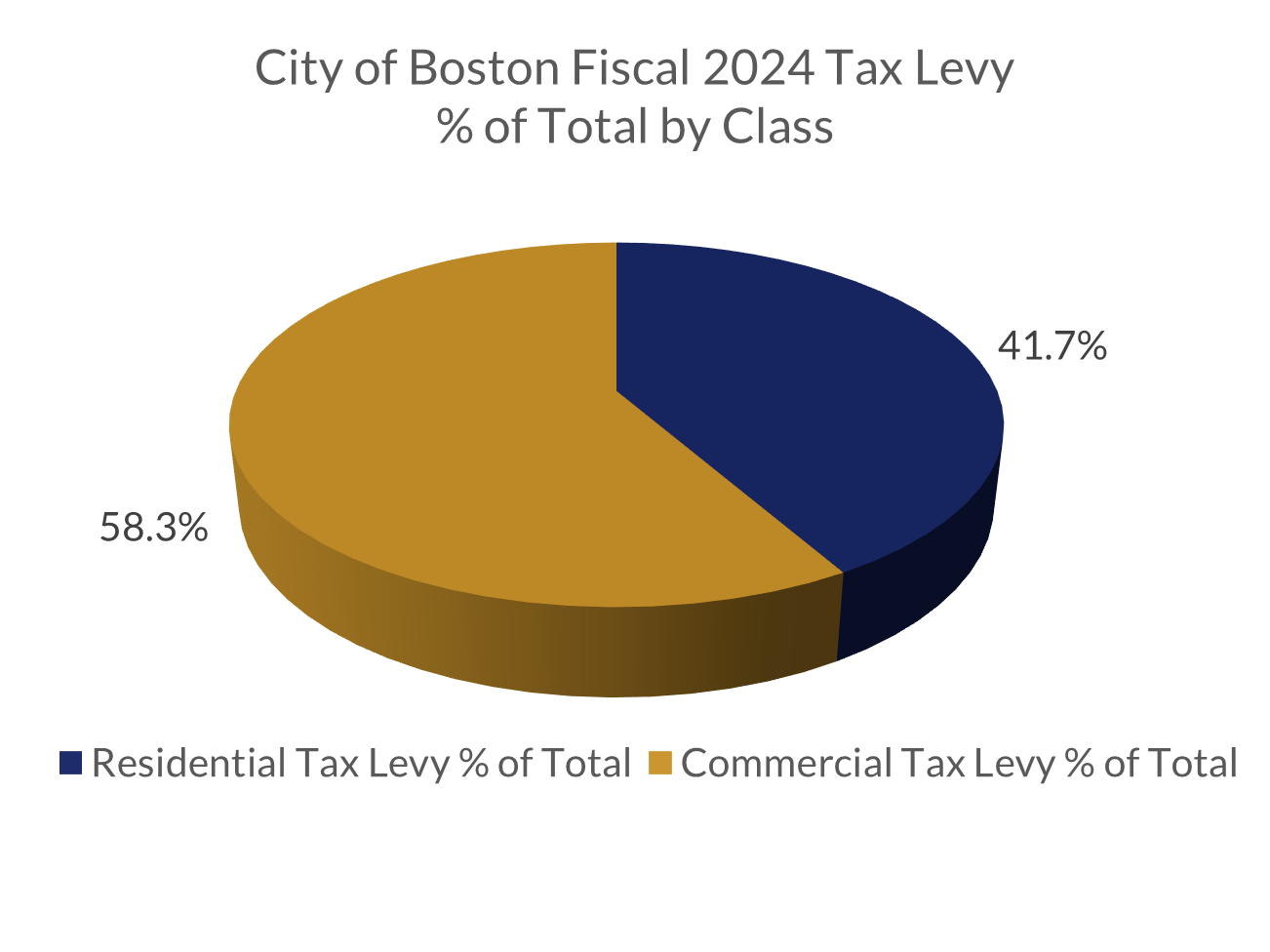

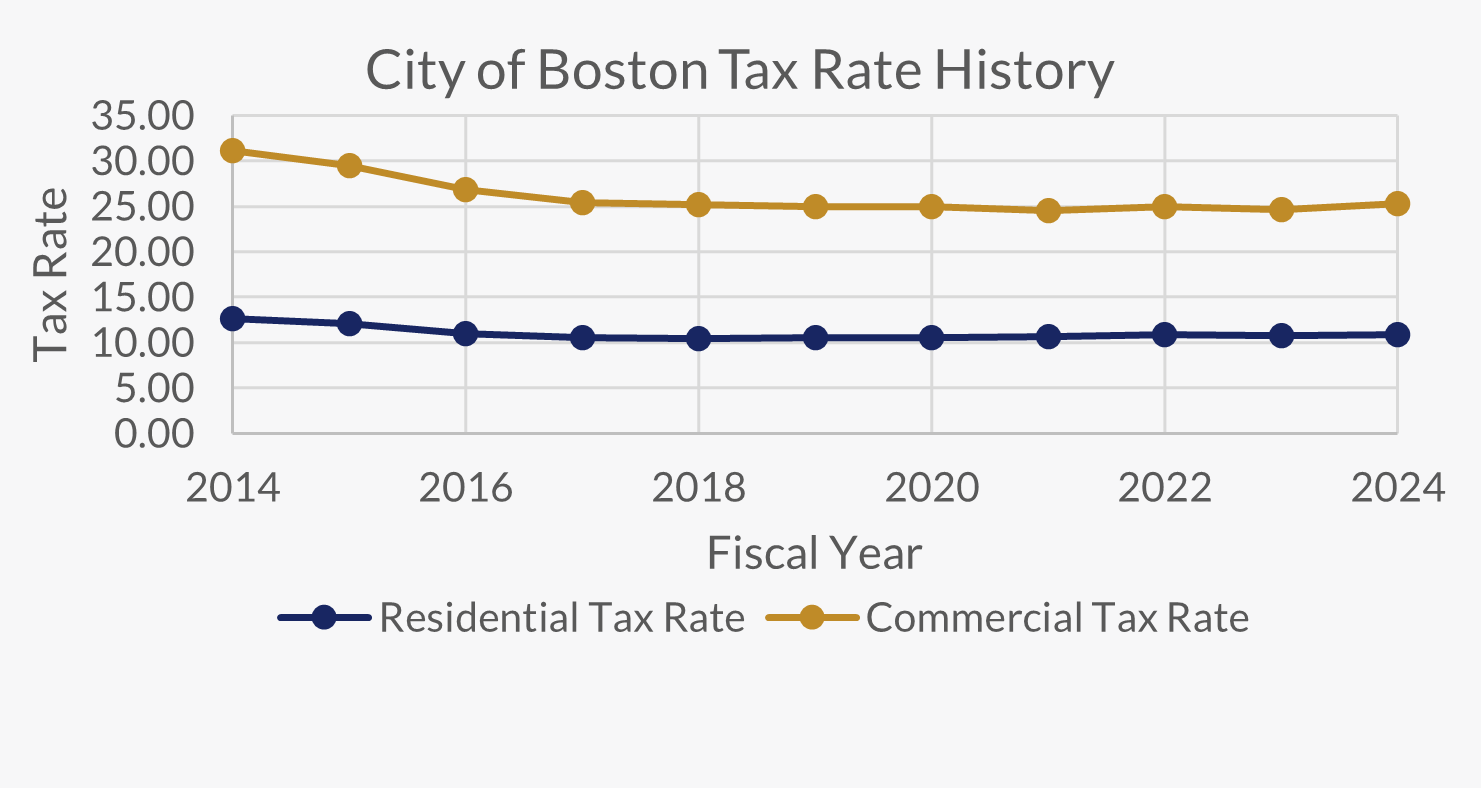

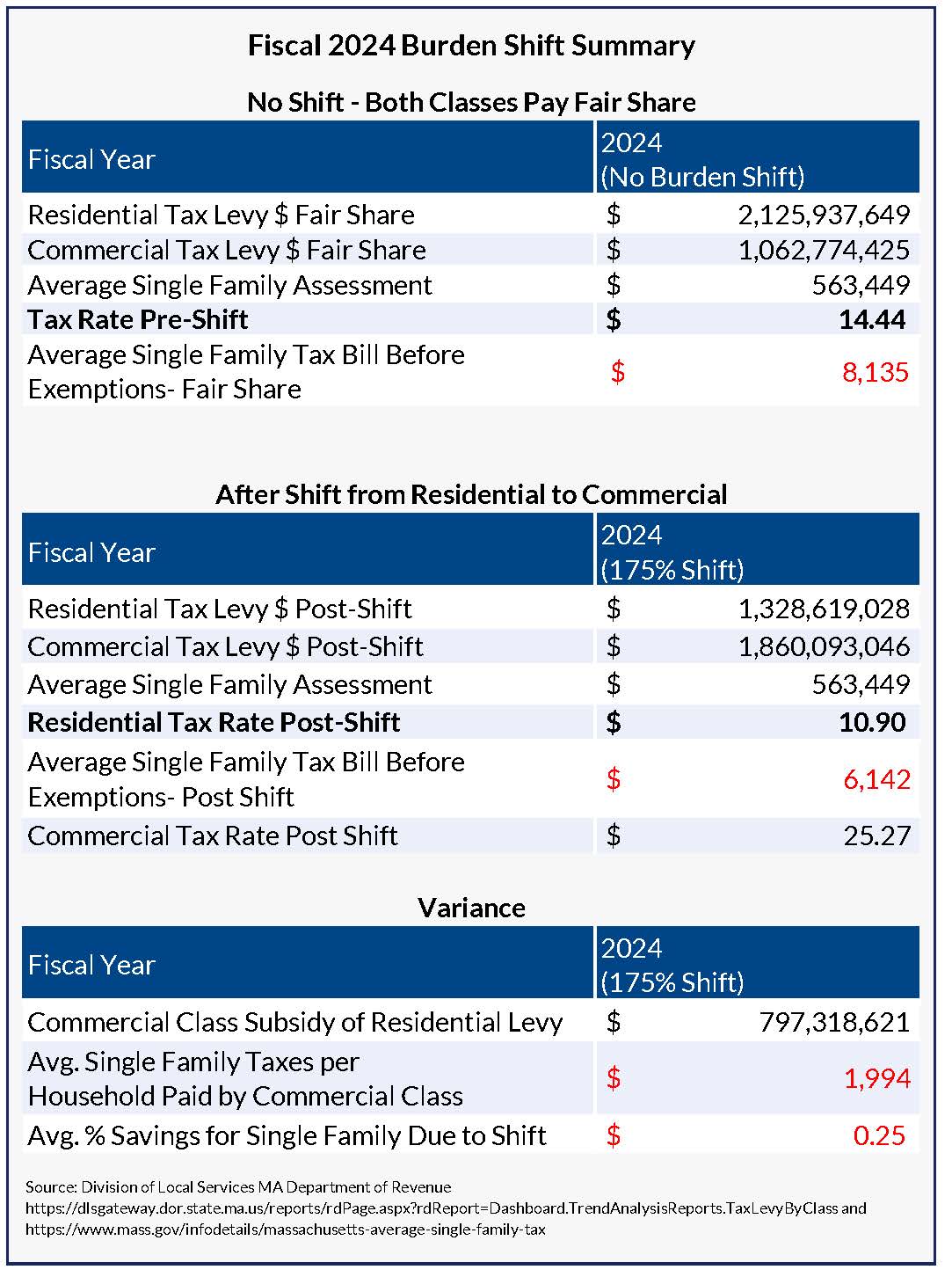

The graphs below illustrate the relationship between the total assessed valuation of each class of property versus the total tax levy borne by each class. As shown below, the relationship between assessed value and the tax levy is effectively flipped so that the commercial class, while accounting for only 33% of the total assessed value in the city, pays 58% of the total tax. This outcome is possible based on current law whereby municipalities may elect to shift property tax burden from the residential class onto the commercial class.17 The law allows cities and towns by local adoption to require the commercial class to pay up to 175% of its fair share of taxes based on assessed valuations, so long as the residential class meets the minimum residential factor requirement which generally equates to 50% of its fair share.18

The mechanics of this tax levy shift work as follows: multiplying the commercial class’s share of assessed value by up to the maximum shift factor of 175%, then applying the inflated/shifted commercial assessment allocation to the City’s total tax levy to determine the property taxes to be paid by the commercial class, with the remainder paid by the residential class. The end result of the shift toward the commercial class is evidenced by split tax rates whereby the residential class pays taxes on a lower tax rate than the commercial class.

Boston has continuously elected to tax the commercial class at the maximum allowable rate by law, 175% of its fair share.19 As a result of the shift, the commercial class, although only making up about 33% of total assessed value, paid about 58% (33% X 1.75) of the total tax levy in fiscal 2024.20 In fiscal 2024, the commercial class absorbed approximately $797 million in additional taxes that would have otherwise been paid by the residential class.21 For single-family homes in Boston, that equates to an average tax savings of 25% or $1,995 per year per household that is being paid for by the commercial class.

3. Current Property Taxes – As Compared Nationally

In addition to the approximate $797 million in residential taxes absorbed by the commercial class, Boston also provides the maximum allowable residential exemption to primary residents.22 For fiscal 2024, the residential exemption provided for the first $331,241 in assessed value to be exempt from tax. This results in up to $3,611 in exempt taxes per property.23 With an average single-family home assessment of $563,449 for fiscal 2024, it equated to a 59% tax exemption per household, with an average remaining tax bill of only $2,531 per year or only $211 per month.24

In addition to the generous residential exemption, the median single-family sale in 2022, which is the relevant lookback period for fiscal 2024, was $761,000 as reported by the City of Boston’s Fiscal 2024 Budget document.25 The result is that homeowners on average pay taxes on only about 30% of the fair market value of their property due to the exemption and undervaluation. This is before taking into consideration the additional relief due to the burden shift onto the commercial class.

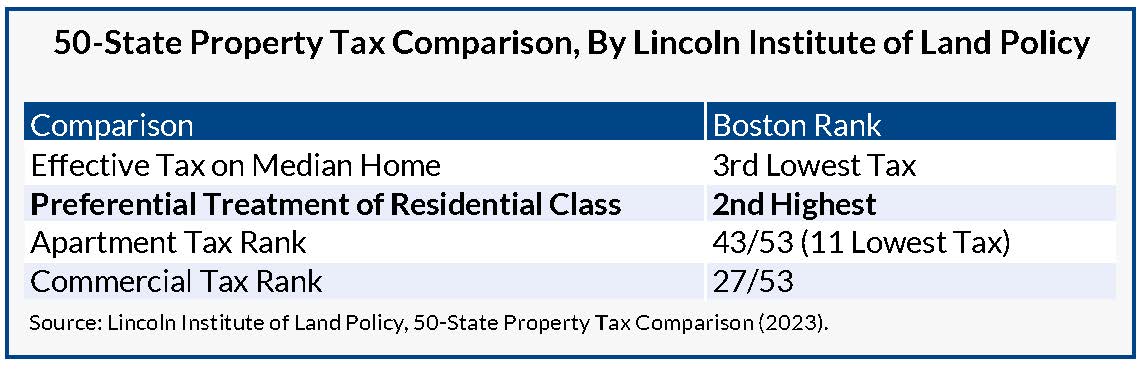

The Lincoln Institute of Land Policy published a thorough report comparing property taxes across the country.26(50-State Property Tax Comparison). The study, last completed in 2023 based on 2022 taxes, analyzed property taxes of the 53 largest cities in all states.27 For residential properties, Boston ranked as the 3rd lowest in the country, behind only Honolulu and Charleston, based on the comparison of the effective property tax rate for median valued homes.28 Apartment properties in Boston were ranked the 11th lowest and commercial properties in Boston were ranked as the 27th highest taxed.29

The Lincoln Institute report also examined the preferential treatment of the residential homestead class as compared to the taxation of the commercial class within the same city.30 Of the 53 largest cities in the United States, Boston has the 2nd highest level of disproportionality between residential and commercial taxes in the country, behind only Charleston, due to the City’s preferential treatment of the residential class.31

II. THE PROPOSED LEGISLATION

The proposed legislation, “An Act Relative to Property Tax Classification in the City of Boston” aims to “…provide a temporary legislative tool to protect residential taxpayers from any potentially drastic increase in property tax bills caused by a decline in commercial values.”32 The Mayor seeks permission to increase the maximum allowable burden shift onto the commercial class in Boston from 175 to 200%, and reduce the minimum burden requirement of the residential class to pay at least 50% of its fair share of taxes down to 45%.33 The bill, if enacted, would commence for fiscal 2025 with an allowance to defer out two fiscal years, and burn off over a five-year period returning to the current standards in fiscal 2029.34

The bill aims to alleviate concern that the residential tax rate will increase in fiscal 2025 due to anticipated decline in commercial valuations coupled with a potential increase in residential valuations. As discussed above, the commercial class made up 33% of total assessed value in the City of Boston in fiscal year 2024 yet paid 58% of the property taxes—the maximum allowed by current law. If the 33% assessed value allocation to commercial property drops due to commercial value declines, so will the corresponding share of the tax levy which results in the residential class taking on more of the tax levy responsibility. To offset the decline in commercial property values, the basis for the shift, the Mayor is proposing to increase the shift percentage to require the commercial class to take on a larger proportion of tax levy.

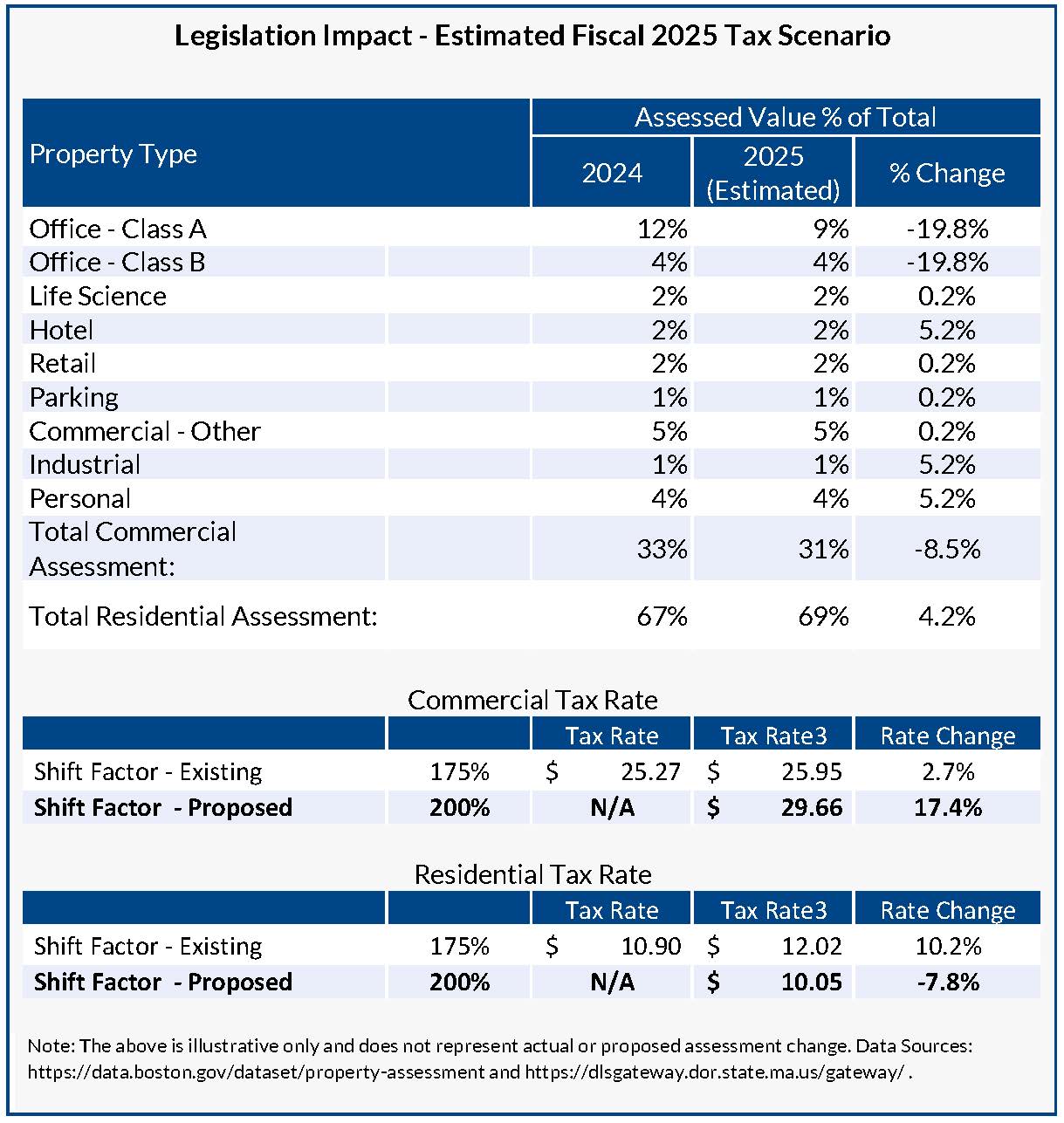

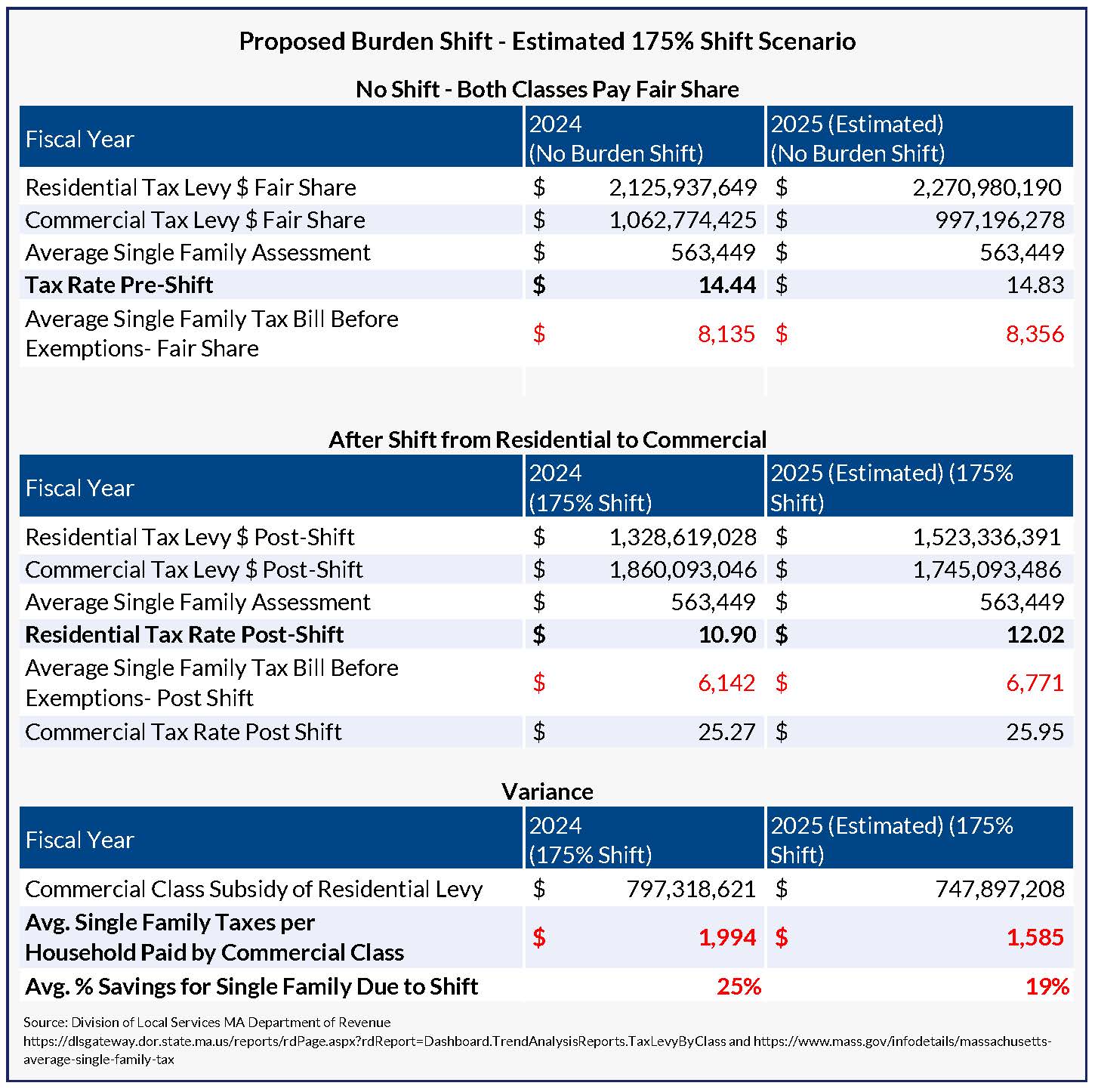

The table below provides an example of the tax consequences for fiscal 2025 based on applying basic assessment adjustments to the fiscal 2024 values. Please note that these adjustment factors are for illustrative and demonstrative purposes only and do not reflect our opinions of commercial or residential values.

Note that all assumptions are static in the above table with the only change being the proposed increase in shift factor from 175 to 200%.

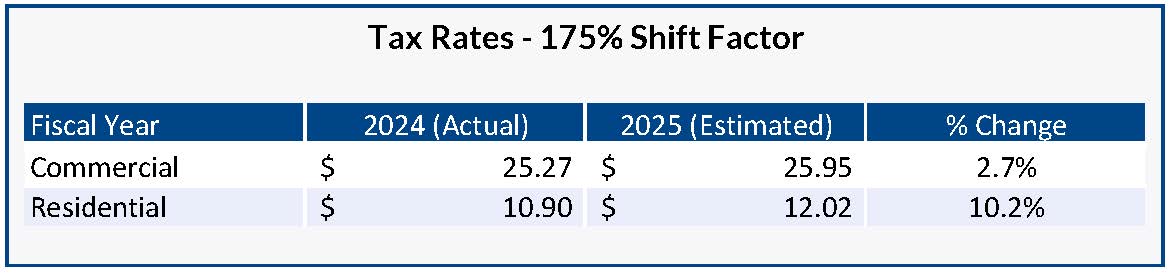

A. Consequences at 175% - Current Shift Allowance

This estimated scenario analyzes tax consequences for the two classes in fiscal 2025 based on the assessment value decline by property type in the commercial class and the 175% maximum shift allowance.

1. Residential

As illustrated in the table above under the 175% shift allowance, the commercial allocation of total assessment in Boston would decrease from 33 to 30% for fiscal 2025. The corresponding tax levy share would decrease from 58 to 53% from fiscal 2024 to 2025. The residential levy share would increase from 42% to approximately 47%. This means the residential class would account for 70% of total taxable assessment and pay 47% of total taxes. The commercial class would absorb $747,819,900 of the residential tax burden under the 175% shift, or approximately $1,585 per household would be funded by the commercial class.

The result under this scenario would be an approximate 10% increase in the residential tax rate in addition to the 4% assessment increase assumed in the model, which is consistent with residential assessment growth observed from fiscal 2023 to 2024 (i.e., the wealth of the average single-family homeowner would increase by about $30,000). The average single-family home’s tax bill, after taking into consideration the residential exemption, would increase $354 for the fiscal year or $29.50 per month.

2.Commercial

Although representing only 30% of total assessed values in the City, the commercial side would be responsible for 53% of Boston’s total property taxes. The commercial tax rate would increase approximately 3% from fiscal 2024. The office sector would receive needed relief in taxes based on real declines in value/wealth, and with assessments down in this scenario 20%, it would receive an approximate 17% tax decrease from fiscal 2024. Please note that this is an average; some office properties under this scenario would see additional reduction in excess of the 17% while others would receive less. All other commercial asset classes would absorb a 3 to 8% tax increase on average.

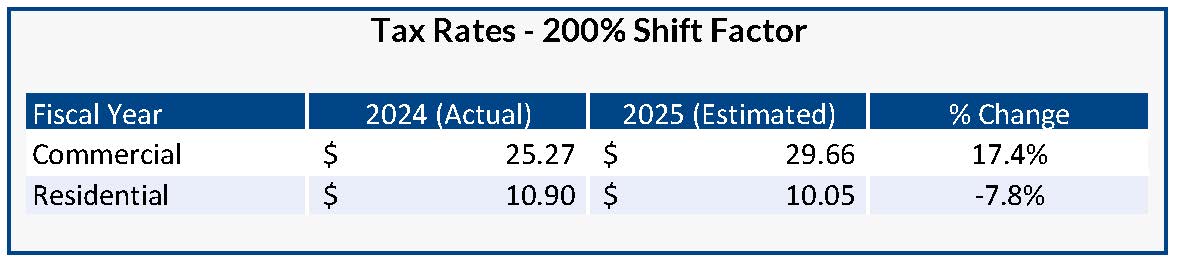

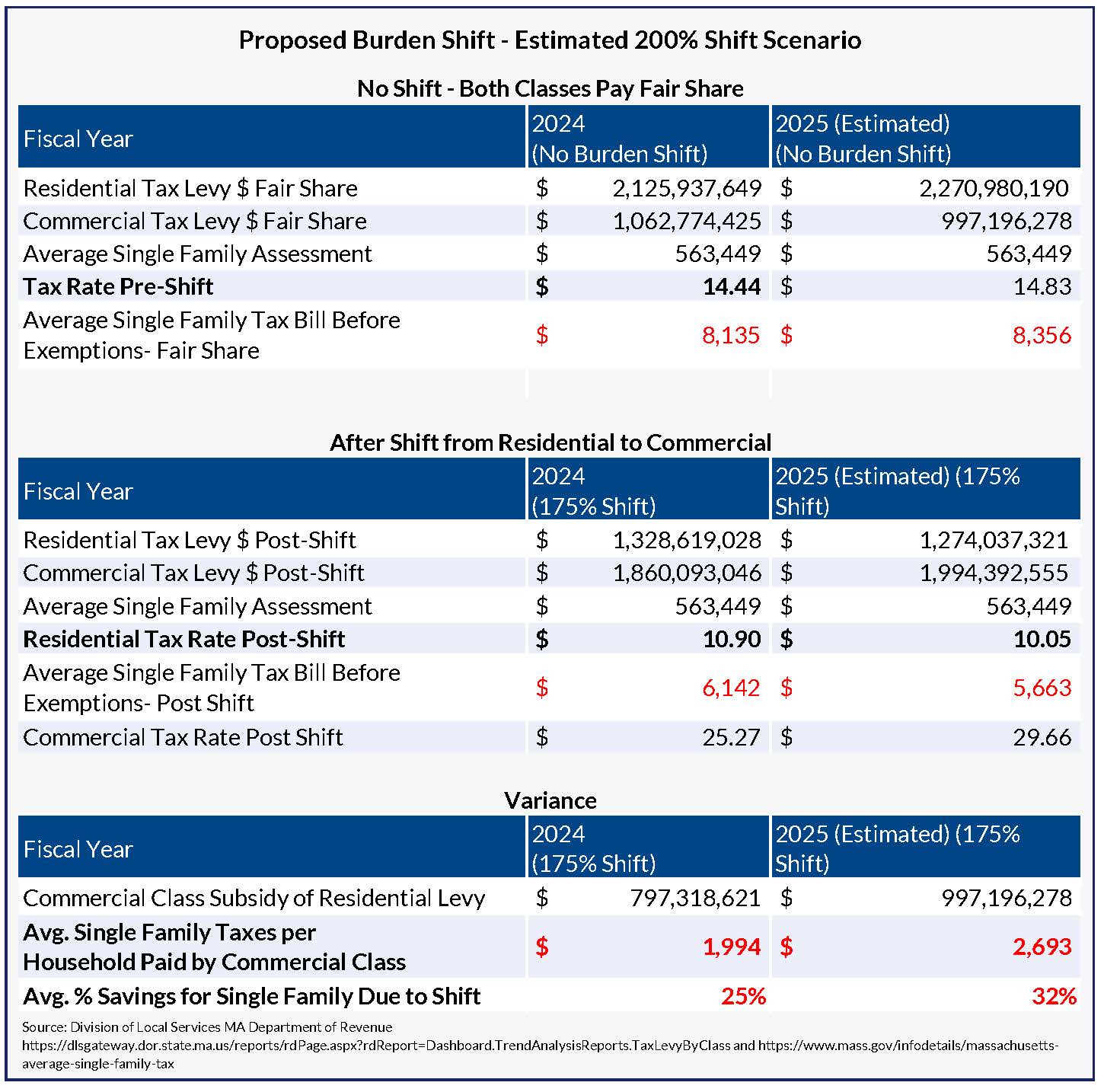

B. Consequences at 200% - Mayor’s Legislation Passes

This scenario assumes the exact same valuation adjustments; however, the commercial burden increases from 175 to 200% per the Mayor’s proposed legislation.

1. Residential

Keeping the same value assumptions but now reflecting the Mayor’s requested 200% burden shift onto the commercial class, it would result in an average tax decrease for the residential class despite an increase in the residential assessed valuation due to increase in wealth for residential homeowners based on market value. Despite the increase in proportionate assessment, the residential tax levy responsibility would decrease from fiscal 2024. The residential class would make up 70% of total assessment and pay only 39% of property taxes.

The average single-family home tax bill would drop $8.67 per month, or $104 for the fiscal year. The commercial class’s subsidy of the residential class would increase from $797 million or $1,995 per household in 2024, to $997 million and $2,700 per household, resulting in 32% of tax per household paid for by the commercial class in 2025.

2.Commercial

Although the decrease in commercial property values would result in a lower proportion of assessed value in the City, the increased shift percentage would result in substantially more taxes borne by the commercial class. The commercial class, making up approximately 30.5% of total assessment in the City, would be responsible for paying 61% of total taxes, twice its fair share. The commercial tax rate would spike approximately 17.5% to a rate of $29.66 while the residential rate would fall by about 8% to a rate of $10.05.

The office class would see a slight decrease of approximately 2.5% in taxes from fiscal 2024 despite market transactions reflecting current tax assessments exceeding market value by 160%.35 Other commercial asset classes outside of office would absorb an increase in property taxes ranging from approximately 17.5 to 23% from fiscal 2024 to fiscal 2025, despite the fact that most are still reeling from the financial impacts of the pandemic and decreased demand.

C. The Impact of Property Taxes on Commercial Properties

Property taxes directly impact the property’s market value, attractiveness to a prospective tenant, and ability for developers to move forward with new construction.

Investment properties are valued based on the ability of the property to generate cash flow. For commercial property owners, property taxes are the single largest expense item outside of debt service. If expense growth outpaces revenue growth, it results in a depreciation of the property’s market value. The proposed legislation aims to increase the property tax expense borne by the commercial class, which will lower cash flows and therefore further exacerbate the decline of commercial valuations within the City.

The spike in the commercial tax rate, approximately 17.5% in the above scenario, would result in not just an offset to office properties declining in value but would also cause a substantial increase in property taxes to those commercial properties deemed stabilized. Property taxes not only impact market value directly as an expense item, but also play a significant role in the ability to market and lease vacant space. For industrial, life science, and retail properties, the tenant is generally responsible for paying their share of property taxes—the higher the taxes, the less desirable the space is to a tenant. For office properties, often the landlord will fully pay the first year’s taxes under a lease while the tenant absorbs all incremental increases over the first year—increased taxes mean less cash flow for landlords to cover their other costs or more cost to tenants who are past their first year (or base year) of the lease term. And who are these tenants? They are the companies who employ the workers in our economy, along with our retailers, restaurant owners, etc. At a time when vacancy rates for commercial properties are at historic highs, this legislation would further inflict hardship on commercial property owners and their tenants and further restrict the marketability of the vacant space. Residential owners in the City of Boston whose wealth is increasing do not need or deserve additional tax subsidy from commercial property owners whose wealth is decreasing.

For developers, the analysis of building a commercial property requires a comparison of the future market value of the project to the costs associated with constructing the building. Property taxes impact a developer’s modeling by reducing potential rents based on increased costs to the tenant, while also increasing their own operating expenses. Apartment developers have the benefit of the residential tax rate, some of the lowest taxes in the country36, along with increasing revenue due to rent growth. Commercial developers are faced with the reality of modeling reduced rents, higher vacancy, higher operating costs, and lower property values. This legislation would impede future commercial development, which the City desperately relies on to exceed the 2.5% annual growth limitation of the property tax levy.

III. SUMMARY

“This home rule petition would provide a temporary legislative tool to protect residential taxpayers from any potentially drastic increase in property tax bills caused by a decline in commercial values.” Mayor Wu, cover letter to the City Council (April 1, 2024).37 The Mayor is stating that due to decline in value of the commercial class combined with value appreciation of the residential class, this bill would allow Boston to increase the property tax levy borne by the commercial class and reduce the tax responsibility of the residential class. It is difficult to make sense of a bill that looks to increase taxes on a class of property that is decreasing in market value while further subsidizing a class because of its appreciation in market value. It is extremely difficult to make sense of such a proposal when you factor in that Boston already has the second highest level of disproportionality between commercial and residential taxpayers in the country.38 Boston has the third lowest property taxes out of major cities across the United States for residential homeowners, and the 11th lowest for apartment owners. Additionally, this bill would increase the already exorbitant tax burden on commercial owners who are desperately attempting to hold onto properties through financial stress and losses caused by record-high vacancies and increased interest rates. Boston should be reviewing ways to revive commercial properties through tax mitigation, not saddling them with additional disproportionate tax burden to reduce tax costs for a thriving class of property whose owners are continuing to increase their wealth.

1 See An Act Relative to Property Tax Classification in the City of Boston (filed April 1, 2024), available at 2024-0642 - Tac Classification (boston.gov).

2 See M.G.L. c. 59, § 21C.

3 See Massachusetts Department of Revenue, Division of Local Services, Levy Limit: A Primer on Proposition 2 ½ , at 8. available at here.

4 Id.

5 Id.

6 Id.

7 Data from the Massachusetts Department of Revenue, Division of Local Services Database, Municipal Levy Limit Reports. available at here.

8 Id.

9 See City of Boston Operating Budget Fiscal Year 2025, p. 20, available at here.

10 See Supra note 2.

11 See Supra note 9 at 63; Department of Revenue, Division of Local Services, Data Analytics, available at here.

12 See City of Boston Property Assessment, Data and Resources, available at here

13 See Department of Revenue, Division of Local Services, Data Analytics, available at here.

14 See Massachusetts Property Classification System, available at here.

15 Id.

16 Id.

17 See M.G.L. c. 58, § 1A.

18 Id.

19 See Supra note 13.

20 See Supra note 13.

21 Id.

22 See City of Boston Operating Budget Fiscal Year 2024, p. 69. available at here.

23 See Supra note 9 at 14.

24 See Department of Revenue, Division of Local Services, Massachusetts Average Single Family Tax, available at here.

25 See Supra note 20 at 70.

26 See “50 State Property Tax Comparison Study for Taxes Paid in 2022” Lincoln Institute of Land Policy (August 2023), available at here.

27 Id.

28 Id. at 2.

29Id. at 24 and 32.

30 Id. at 3-4.

31 Id.

32 See Supra note 1.

33 Id.

34 Id.

35 Based on review of median office sale prices recorded in 2023 & 2024 as compared to property’s fiscal 2024 assessments. See sales of 101 Arch St, 268 Summer St, 186 Lincoln St, 110 Canal St, 33 West St, 1 Liberty Sq, 125 Broad St, 281 Franklin St.

36 See Supra note 27.

37 See Supra note 1.

38 See Supra note 28.