Unmatched Results

We go beyond the expected and look for the exceptions that benefit our clients. By reviewing the exact time periods and types of tax as our competitors, we produce substantial additional results.

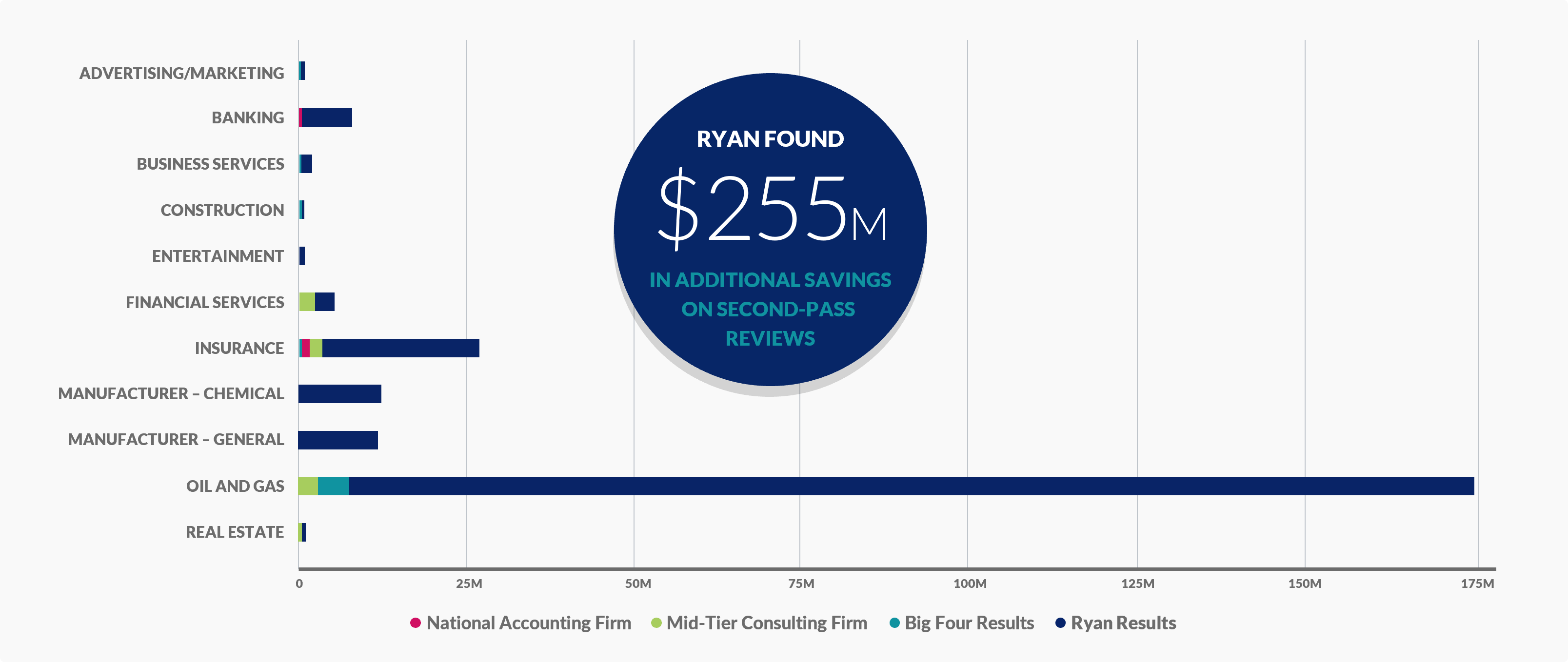

$255 Million in Additional Tax Savings

Without our follow-up review, these clients would have lost a staggering $255 million in tax savings. We go beyond the expected and look for the exceptions that benefit our clients. By reviewing the exact time periods and types of tax as our competitors, we produce substantial additional results.

We're at our best when following other, less focused, firms. And our competition doesn't bother to follow us. We know of no instance where any of our competitors have produced meaningful tax savings after our review was complete.

Client Success Stories

Ryan has been a trusted partner of CBS Corporation for many years, consistently delivering incredible value and substantial savings.

Ryan has secured millions of dollars in tax savings for Chrysler, consistently providing outstanding client service and value.

Ryan's integrated tax services delivered outstanding value and substantial savings in multiple tax areas, including sales tax, payroll tax, and customs duty.

Ryan provided our organization an outstanding return on investment that goes well beyond the impressive tax savings that they delivered.

Ryan has brought several ideas to us that we hadn’t looked at before. We’re going to end up with significant savings from something that we would have totally passed on if Ryan hadn’t brought this to our attention.

Practice Area Expertise Focused on Results

Our efforts produce superior results for our clients. Simply put, our commitment to excellence and utilization of sophisticated technology ensure that we're more thorough, efficient, and effective than our competitors. We don't simply review our clients' records for tax-reduction and tax-saving opportunities; we scour them. And the results speak for themselves.

Credits and Incentives

- $50 million in tax and infrastructure cost savings for a manufacturer of plastics products

- $15.9 million in enterprise zone refunds for a major oil company

- $5.2 million in tax and other savings for a garage door manufacturer

- $4.5 million in tax and other savings on a consolidation project for a consumer products manufacturer

- $3.8 million in tax savings for a plastic, polyurethane, and sealant manufacturer

- $2.2 million in grants and tax credits for an investigative and support services company

Fuels and Excise Tax

- $2.2 million in tax refunds for a major airline company

- $.9 million in tax refunds for a major concrete company

- $.8 million in tax refunds for a major helicopter company

- $.6 million in tax refunds for a major electric utility company

Income and Franchise Tax

- $13 million in tax refunds for an oil and gas exploration and production company

- $10 million in tax refunds for a gas transportation company

- $1.2 million in tax refunds for an auto manufacturer

- $.3 million in tax refunds for a medical supply manufacturer

Property Tax

- $12.5 million in tax savings for a major chemical manufacturer

- $9 million in tax savings for an electric power generation company

- $3.4 million in tax savings for a media conglomerate

- $1.8 million in tax savings for a wire and cable manufacturer

Sales and Use Tax

- $80.3 million in tax savings for a major defense contractor

- $70.4 million in tax savings for a major cable company

- $48.6 million in tax savings for a major retailer

- $38.1 million in tax savings for a major healthcare company

- $36.4 million in tax savings for a major financial institution

- $32.3 million in tax savings for a major energy services company

- $24.6 million in tax savings for a major high-tech equipment manufacturer

- $23 million in tax savings for a major commercial airline

Severance Tax

- $15.8 million in tax credits for an integrated global energy company

- $6.1 million in tax credits for a large, independent oil and gas producer